Euro Outlook - EUR To GBP Exchange Rate Trends Higher, EUR Gains Vs Dollar, Rupee, Aus Dollar & South AfricanRand

euro exchange rate against pound, dollar and rand

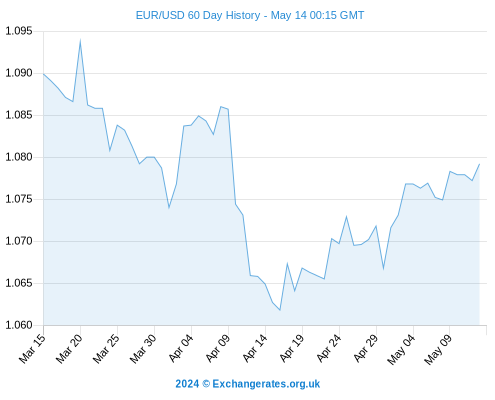

In a comparatively quiet exchange rate session, the Euro (EUR) trended in a fairly narrow range against the Pound (GBP) and US Dollar (USD) on Monday.

While the Pound Sterling (GBP) was trading slightly higher thanks to some pro-union Scottish independence survey results, the Euro exchange rate complex was pressured by domestic developments.

A big forex week lies ahead in terms of economic data releases, most notably the Scottish referendum this thursday 18th September, promising large movements for the Euro and British Pound units.

`

Before we delve deeper into the latest EUR/GBP analysis, let's look at where the key global forex rates stand today:

- The euro to australian dollar exchange rate converts 0.3 per cent higher at 1.43658.

- The euro to pound exchange rate is 0.35 per cent higher, converting at 1 EUR is 0.80024 GBP.

- The euro to dollar exchange rate is +0.06 per cent higher at 1.29470.

- The dollar to euro exchange rate converts 0.06 per cent lower at 0.77238.

- The dollar to pound conversion rate is +0.29 per cent higher at 0.61809.

- The euro to rupee rate is 1 EUR converts as 79.105 INR.

Please Note: these are inter-bank forex rates to which margins are applied when comparing money transfers abroad - speak to a recommended FX provider to lock in the best foreign exchange rates.

Euro Weakness Thanks to ECB

Some of the Euro’s weakness was due to the fact that the European Central Bank is preparing to roll out the stimulus measures highlighted in their last policy meeting.

The common currency was also adversely affected by the news that the Organisation for Economic Co-operation and Development (OECD) cut its growth forecasts for several of the world’s largest economies.

The OECD slashed its growth projections for both the Eurozone and US and now envisages the 18-nation currency bloc growing by just 0.8% in 2014.

This is quite a comedown from the previous prediction of growth of 1.2%. Growth of 2.1% is forecast for the US, also down from initial estimates of 3.1% expansion.

Growth predictions for 2015 were reduced and OECD economist Rintaro Tamaki commented; ‘This highlights the possibility that risk is being mispriced again and the attendant danger of sudden corrections in the financial markets.’ In contrast, the UK is expected to enjoy some of the strongest levels of economic growth among all the developed nations.

When speaking of the Eurozone’s lack of economic momentum, Tamaki noted; ‘Recent ECB action is welcome but further measures, including quantitative easing, are warranted. The perception that policy action is always too little too late needs to be changed.’

This opinion was seconded by top ratings agency Standard & Poors, who issued the following statement on Monday; ‘In our view, the vulnerability of the recovery in the Eurozone, the elevated risks of a triple dip, and the threat of negative inflation would justify the recourse to additional non-conventional measures.’

The EUR/GBP eased to a low of 0.7943 during the European session but returned to trade within the region of 0.7970.

The Eurozone’s trade balance figures had little impact on the Euro to Pound exchange rate. While the region’s non-seasonally adjusted trade surplus widened on a year-on-year basis, the seasonally adjusted trade surplus contracted from 13.8 billion Euros in June to 12.2 billion Euros in July.

Euro to Pound Exchange Rate Forecast - The Week Ahead

In the week ahead the EUR/GBP exchange rate can be expected to experience considerable volatility as a result of several key news items. Tomorrow fluctuations will be driven by the UK’s Consumer Price Inflation data and the Eurozone’s ZEW economic sentiment surveys. Last month the ZEW gauge of German economic sentiment fell by a whopping 18.5 points, taking the measure to 8.6 and undermining demand for the Euro. Another slide in confidence would be detrimental to the Euro and could help the Pound advance. That being said, a slowing in UK inflation would weigh on the British asset. As the week progresses, additional Euro to Pound exchange rate movement will be caused by the UK’s employment figures, the Bank of England’s meeting minutes and the outcome of the Scottish referendum. In terms of economic reports from the Eurozone, the big ones to watch out for include final CPI for the Eurozone, Eurozone construction output, German Producer Prices and Eurozone current account figures. Investors will also be focusing on the upcoming Federal Open Market Committee interest rate announcement. While the central bank is unlikely to make any alterations to fiscal policy at this time, and is expected to stick with the steady tapering of stimulus, particularly hawkish or dovish commentary would spark movement in the currency market. The EUR/GBP exchange rate hit a high of 0.7984 on Monday

In a comparatively quiet exchange rate session, the Euro (EUR) trended in a fairly narrow range against the Pound (GBP) and US Dollar (USD) on Monday.

While the Pound Sterling (GBP) was trading slightly higher thanks to some pro-union Scottish independence survey results, the Euro exchange rate complex was pressured by domestic developments.

A big forex week lies ahead in terms of economic data releases, most notably the Scottish referendum this thursday 18th September, promising large movements for the Euro and British Pound units.

`

Before we delve deeper into the latest EUR/GBP analysis, let's look at where the key global forex rates stand today:

- The euro to australian dollar exchange rate converts 0.3 per cent higher at 1.43658.

- The euro to pound exchange rate is 0.35 per cent higher, converting at 1 EUR is 0.80024 GBP.

- The euro to dollar exchange rate is +0.06 per cent higher at 1.29470.

- The dollar to euro exchange rate converts 0.06 per cent lower at 0.77238.

- The dollar to pound conversion rate is +0.29 per cent higher at 0.61809.

- The euro to rupee rate is 1 EUR converts as 79.105 INR.

Please Note: these are inter-bank forex rates to which margins are applied when comparing money transfers abroad - speak to a recommended FX provider to lock in the best foreign exchange rates.

Euro Weakness Thanks to ECB

Some of the Euro’s weakness was due to the fact that the European Central Bank is preparing to roll out the stimulus measures highlighted in their last policy meeting.

The common currency was also adversely affected by the news that the Organisation for Economic Co-operation and Development (OECD) cut its growth forecasts for several of the world’s largest economies.

The OECD slashed its growth projections for both the Eurozone and US and now envisages the 18-nation currency bloc growing by just 0.8% in 2014.

This is quite a comedown from the previous prediction of growth of 1.2%. Growth of 2.1% is forecast for the US, also down from initial estimates of 3.1% expansion.

Growth predictions for 2015 were reduced and OECD economist Rintaro Tamaki commented; ‘This highlights the possibility that risk is being mispriced again and the attendant danger of sudden corrections in the financial markets.’ In contrast, the UK is expected to enjoy some of the strongest levels of economic growth among all the developed nations.

When speaking of the Eurozone’s lack of economic momentum, Tamaki noted; ‘Recent ECB action is welcome but further measures, including quantitative easing, are warranted. The perception that policy action is always too little too late needs to be changed.’

This opinion was seconded by top ratings agency Standard & Poors, who issued the following statement on Monday; ‘In our view, the vulnerability of the recovery in the Eurozone, the elevated risks of a triple dip, and the threat of negative inflation would justify the recourse to additional non-conventional measures.’

The EUR/GBP eased to a low of 0.7943 during the European session but returned to trade within the region of 0.7970.

The Eurozone’s trade balance figures had little impact on the Euro to Pound exchange rate. While the region’s non-seasonally adjusted trade surplus widened on a year-on-year basis, the seasonally adjusted trade surplus contracted from 13.8 billion Euros in June to 12.2 billion Euros in July.

Euro to Pound Exchange Rate Forecast - The Week Ahead

In the week ahead the EUR/GBP exchange rate can be expected to experience considerable volatility as a result of several key news items. Tomorrow fluctuations will be driven by the UK’s Consumer Price Inflation data and the Eurozone’s ZEW economic sentiment surveys. Last month the ZEW gauge of German economic sentiment fell by a whopping 18.5 points, taking the measure to 8.6 and undermining demand for the Euro. Another slide in confidence would be detrimental to the Euro and could help the Pound advance. That being said, a slowing in UK inflation would weigh on the British asset. As the week progresses, additional Euro to Pound exchange rate movement will be caused by the UK’s employment figures, the Bank of England’s meeting minutes and the outcome of the Scottish referendum. In terms of economic reports from the Eurozone, the big ones to watch out for include final CPI for the Eurozone, Eurozone construction output, German Producer Prices and Eurozone current account figures. Investors will also be focusing on the upcoming Federal Open Market Committee interest rate announcement. While the central bank is unlikely to make any alterations to fiscal policy at this time, and is expected to stick with the steady tapering of stimulus, particularly hawkish or dovish commentary would spark movement in the currency market. The EUR/GBP exchange rate hit a high of 0.7984 on Monday

http://www.exchangerates.org.uk

Post a Comment

ما رأيك ..... شاركنا الرأي